In India, ask any long-term investor to call their apartment legends, and the eemer engines will probably be at the top of that list.

In 2009, 3,200 rubles from Rs 30 Funds to 2017 (adjusted to split shares), Eyer simply did not turn the motorcycle, set it. But Eicher’s success was simply not built on bicycles. It was built on the vision. It noticed the aspiration before the market even knows that it exists and built a lifestyle brand around it.

The result. One of the most common stories in the history of the Indian Market history.

Fast progress until 2025. Eicher Motors are no longer about motorcycles. It is more global and diversified and has been calmly equipped with ~ 30% cagration over the past five years.

Now comes the main question. Can he shoot another multi-year rally or already the best price?

Let’s look closer.

Eicher Motors Ltd. Share Price Table (Apr 7 06 to live ‘)

Eicher Motors Stock Prices Motion. Source: Screener.in

Eicher Motors Stock Prices Motion. Source: Screener.in

Under Hood. Business built for bilateral growth

When it is known exclusively for its illustration, Eicher Motors turned into a bilateral power plant, guided by Royal Enfield’s Premium Motorcycle Legacy and Volvo-Eicher commercial vehicles (VECV).

History continues under this ad

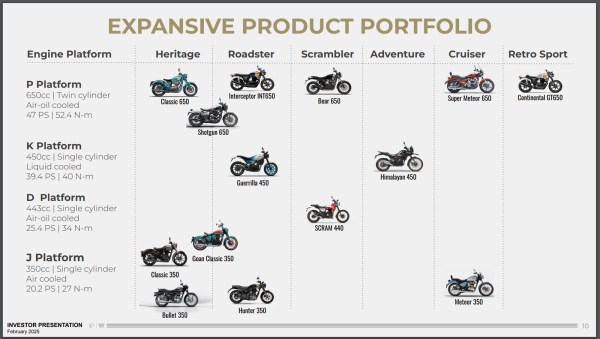

Royal Enfield Product Portfolio: Source: Investors presentation on December 24

Royal Enfield Product Portfolio: Source: Investors presentation on December 24

What makes Eicher interesting, only his legacy is how two business hands prepare to grow in many different markets.

Royal Enfield. Building on heritage, targeting global priority

Eicher’s brand and its most powerful earn-eared engine remains Royal Enfield.

Although India’s messy bilateral market, Royal Enfield’s positioning in the medium-term motorcycle section (250cc-750cc) gives it a clear competitive advantage.

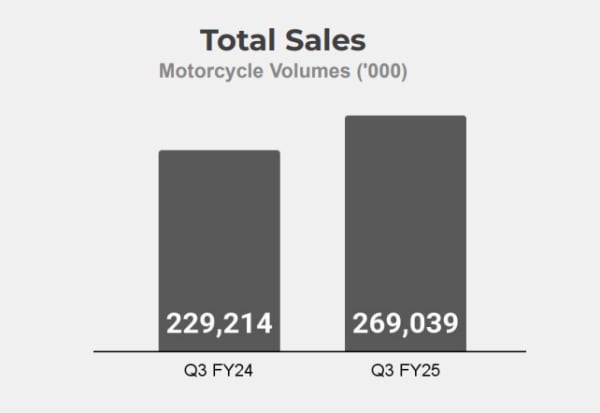

In Q3FY25, Royal Enfield posted a strong increase in the growth of 17.5% by selling more than 2.7 lakh points.

History continues under this ad

Motorcycle YoY sales. Source: Investors presentation on December 24

Motorcycle YoY sales. Source: Investors presentation on December 24

This growth came, despite the average sales price (ASP) on one bike, a little dip due to a mixture of developing products, but still reflecting the price of prices in the value market.

It is noteworthy that this growth was not guided only by heritage models. Royal Enfield has launched five new motorcycles in the quarter, including Bear 650, Bullet Battalion Black and Scram 440.

The company also opened a collection plant in Thailand (entirely knocked down) to serve assee markets and develops another institution. These facilities will allow Royal Enfielf to bypass import responsibilities and effectively meet regional demand.

By adding a future leading layer, Royal Enfield revealed its very expected EV brand, flying news. It is expected that production at its Vallamery will start at Q1FY26 with an annual capacity of 1.5 lakh points per year.

History continues under this ad

Rather than instead of rushing the EV race, Eicher seems to be the basis for a large-scale electrical offer.

VECV. Quiet investor with scale potential

Although Royal Enfield sets a brand, VECV, Eicher’s joint venture with Volvo, more and more important investment for both income and diversification.

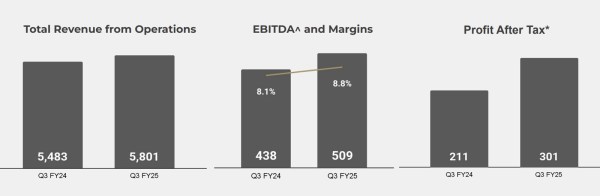

At Q3FY25, VECV received 5,801 Rs Rs Grore, 6% growing YOY and installed 42% Pat growth. Ebitda’s margin arrived at 8.8%, 80 points per annum.

VECV YOY sales. Source: Investors presentation on December 24

VECV YOY sales. Source: Investors presentation on December 24

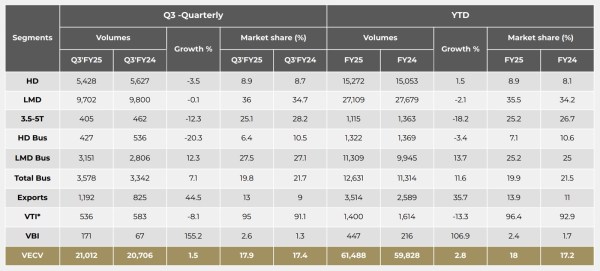

The volumes were stable with 21,012 points, but the history of market shares tells more.

History continues under this ad

Currently, VECV monitors 36% of the LMD truck market, 9% overloaded (HD) trucks, and more than 20% on buses.

VECV Quarter and YTD Sale: Source: Investor presentation on December 24

VECV Quarter and YTD Sale: Source: Investor presentation on December 24

With the pressure of government infrastructure and raising the last mile logistics, the VECV is well positioned.

Pro-X is a key future lever, the new VECV’s new “electric-first” LCV platform. This can be 2-3.5 tons of transforming a new Eicher market, e-commerce and intra-community logistics.

Financial discipline. Growth without pulling the balance

During the extension, Eicher retained one of the clean balance of Indian car industry.

History continues under this ad

As of FY25, the company remains a debt of more than 1,000 RO in Capex this year, which is aimed at the development of products, EV to expand global capabilities.

Management on Capex program. Source: Investors presentation on December 24

Management on Capex program. Source: Investors presentation on December 24

Operational measurements also remain stable.

The return of shares (ROE) has been stabilized by about 24%, and each share (EPS) earnings are planned to grow to find out stable teenage earnings cagr.

Evaluation check. What is the price and what is?

History continues under this ad

Note: This is not predicting where the price can be managed. It’s just if-then calculated for scientific purposes.

The current market price is about 5,400 Rs, Eicher Motors trading on 33x FY25 earnings. It can raise eyebrows in the market where many car reserves are soaring in the 15-25x range.

But there is an important context here.

Eicher was never sold like a regular car company because it was rarely stored like one.

Historically, the shares were ordered to premium multiple, not only because of the equity of the Royal Enfield brand, but also high-return stable flows and net cash balances.

History continues under this ad

Even now the return of shares is 24%, free yield of cash flow is healthy without any debt of books.

However, the last rally has already had the price in the fair share of optimism. The next stage of expanding the assessment, if any, will most likely depend on the implementation and outcome of a number of strategic initiatives.

The main variable will be the scale of international actions, particularly through the CKD collection model in Thailand, Brazil and other markets. These features are designed to reduce import costs and improve margins in export markets.

If these areas will begin to wisely contribute to both extensive and profitable, it can improve the quality of earnings medium-term.

In addition, EV portfolio operation and acceptance of the flying light, the start of FY26 will be closely considered.

Early indicators of the expenditure structure and the potential of the product market will play a role in determining this vertical long-term modernity.

The ability of VECV to maintain marginal discipline on the side of the trading vehicles, the scale of the scale of light and older trucks, buses and more new platforms, will affect consolidated financial activities.

Government’s infrastructure costs and the latest mile logistics tendencies will remain important demand drivers.

If the performance in these areas agrees to expectations, and if the retaliation of margin is followed by a current investment cycle, business can support higher earnings over higher earnings.

However, any deviations on growth, international performance or ev ramp-up may affect the stability of evaluation, especially in the market where expectations have already been raised.

In the current context, it is stated by supportive earnings, predictable earnings and an effective investor, a premium market trends. Further disorder or compression in multiplication of evaluation will depend on the designated strategic goals and the actual delivery.

Note: This article relies on annual report and industry reports. We have used our assumptions to predict.

Parth Parikh has more than a decade in finance and research, and currently leads the growth and content of Finsire. He is of great interest in Indian and global stocks and keeps FRM chartered together with the MBA funded from the MBA institute of Nars Mongel Management Studies. He used to hold research positions in various companies.

Discovery. The writer and his dependence do not keep the shares discussed in this article.

Website managers, its employees (s) and writers have features of securities and other companies. The content of the articles and the interpretation of data are personal views of investors / writers / authors. Investors must make their investment decisions on the basis of their special goals and resources, and only after the independent consultants consulted.