rewrite this content and keep HTML tags

The huge debt passed from one generation to the next has increased the problems of the farmers of Haryana.

Chamkaur Singh’s family owed Rs 25,000 fifteen years ago, but now this amount has become Rs 9 lakh. The interest alone exceeds Rs 75,000 annually.

,Everyone in Haryana is in debt,” he adds.

The Kisan Credit Card (KCC) scheme, launched in 1998, was designed to provide easy, short-term loans to farmers based on their land holdings. Farmers can borrow up to Rs 1 lakh per acre, while loans up to Rs 3 lakh attract 7 per cent interest rate.

Subsidy is available for those who repay the principal within one year. While helpful, the scheme does not meet all the needs of farmers. Many people depend on brokers for money during emergencies like weddings, medical treatments or daily expenses at hefty annual interest rates of 18-24 per cent.

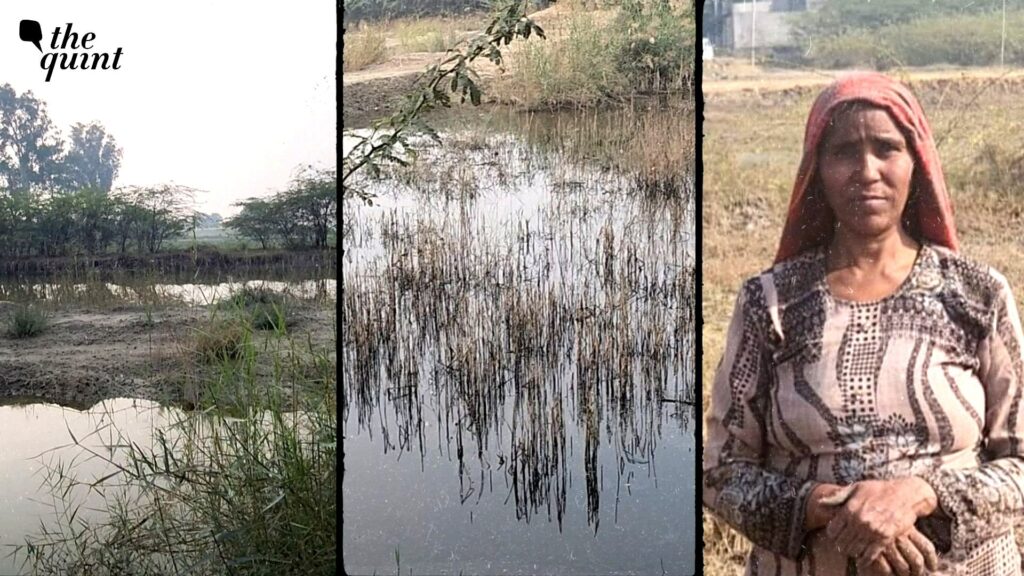

“The relationship between the commission agent and the farmer is like body and soul. Government wants to eliminate middlemen three agricultural lawsBut we do not support that. We work closely with commission agents because we do not get adequate support from banks. Banks will not give us loans without collateral, but commission agents give us the credit we need for health emergencies, weddings or house construction,” says Anita Sudkan.

Agricultural Acts of 2020 faced strong opposition from farmers arhtiyas Who feared that these laws would threaten their livelihoods and existing support systems. Nationwide protests continue, with farmers demanding repeal of the laws and legal guarantee of minimum support price (MSP) for crops.

This plight is not only of the farmers of Haryana. More than 50 percent of farm households in India are in debt, with the average outstanding loan per household at Rs 74,121, according to a 2021 National Statistical Organization (NSO) survey.